How Students and Taxpayers Are Funding Risky UC Borrowing and Wall Street Profits

By Charlie Eaton, Jacob Habinek, Mukul Kumar Tamera Lee Stover, Alex Roehrkasse, and Jeremy Thompson

The Berkeley Journal of Sociology version of this article is available here.

TABLE OF CONTENTS

- Executive Summary

- Introduction

- From Risky Deal to Losing Bet: A Short History of UC’s Interest Rate Swaps

- Responding to Derivative Disasters

- Why Hasn’t UC Management Renegotiated?

- Recommendations

- Appendix

- Endnotes

This report examines the role of interest rate swaps in the University of California’s massive expansion of borrowing from Wall Street over the last decade. The report highlights the costs to students and taxpayers of UC’s interest rate swaps and debt-driven profit strategies. Such strategies have been called into question for Wall Street banks, let alone for public universities. Based upon our findings, we offer recommendations regarding renegotiation of UC’s interest rate swaps and the governance practices for UC’s overall borrowing program. Key findings include the following:

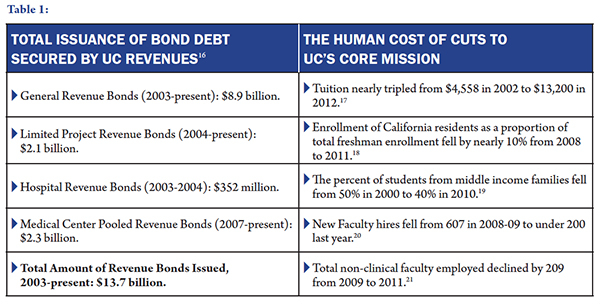

- A UC management has more than doubled the university’s debt burden from $6.9 billion in May 2007 to $14.3 billion at the end of 2011. Rather than contributing to UC’s core mission, funds have been directed toward more profitable UC enterprises like medical centers and attracting out-of-state students. Medical center profits have increased steadily to $900 million annually last year. Out-of state enrollment has doubled across UC—increasing from 11% to 30% at UC Berkeley.

- UC borrowing is often backed by student tuition, but profits on debt-funded investments have not been used to mitigate service cuts or tuition hikes. As a result, students are made to bear the costs and the risks of poor returns, but have not received benefits from positive returns: tuition has increased 300% since 2002 and total enrollment of freshmen from California declined by 10% from 2008 to 2011.

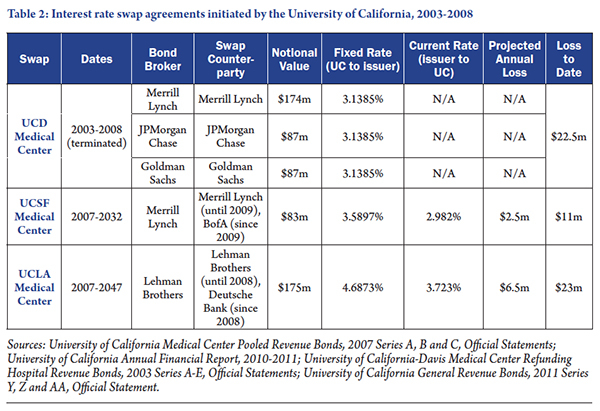

- UC is currently losing about three-quarters of a million dollars each month on interest rate swaps associated with debt issued for two of its medical centers. Since 2003, UC’s swap agreements have cost the university nearly $57 million and could cost the university another $200 million.

Given these Findings We Offer Three Recommendations:

- UC should seek to renegotiate its interest rate swap agreements with Deutsche Bank and Bank of America. Given record-low interest rates and the manipulation of LIBOR rates scandal, public institutions around the country are holding banks accountable by renegotiating interest rate swaps. In the Bay Area, the San Francisco Asian Art Museum successfully terminated its swaps without penalties, saving the museum $40 million, and the City of Richmond renegotiated its swaps, saving taxpayers $5 million a year. The City of Oakland has also unanimously voted to renegotiate its swap agreements.

- UC should explore the possibility of LIBOR litigation. All of the swaps covered in this report use LIBOR as the basis for the variable rate received by UC from its bank counterparties. There are over a dozen banks under investigation for LIBOR manipulation, including JPMorgan Chase, Bank of America, Goldman Sachs and Deutsche Bank. Some of these banks have served or continue to serve as counterparties for UC’s swaps. We estimate that UC paid banks about $1.92 million more than it should have absent the alleged manipulation of LIBOR between August 2007 and May 2010. If UC were to successfully file suit under federal antitrust statues and seek treble damages, the university may be entitled to $5.76 million.

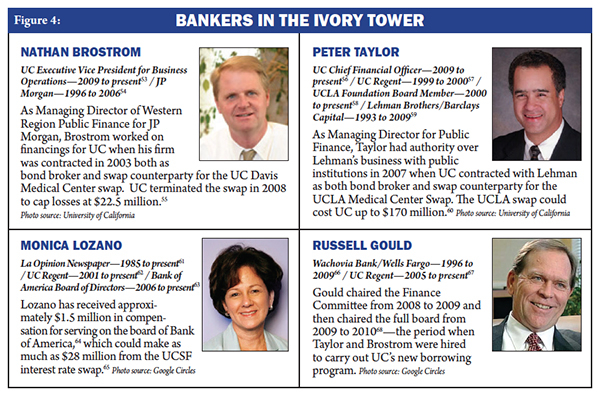

- UC should increase transparency in the governance of its borrowing practices by appointing a committee of delegates from key UC communities — including persons from independent student organizations, faculty organizations, employee unions, and parents — to conduct a comprehensive review. UC’s outstanding swap agreements are held by Wall Street banks with close ties to UC Regents and executives. Such relationships and potential conflicts of interest must be scrutinized so that swap renegotiation decision-making processes are both transparent and accountable to all UC stakeholders. Key relationships for examination include:

-

- UC Regent and former Regents Finance Committee Chair Monica Lozano has received approximately $1.5 million in compensation for serving on the board of Bank of America,1 which could make as much as $28 million from the UCSF interest rate swap.2

- In his previous job as Managing Director for Public Finance for Lehman Brothers, UC’s current CFO Peter Taylor was serving on the UCLA Foundation board at the same time he had authority over Lehman’s business with public institutions in 2007 when UC contracted with Lehman as both bond broker and swap counterparty for the UCLA Medical Center Swap. The UCLA swap could cost UC up to $170 million.3

- In his previous job as Managing Director of Western Region Public Finance for JP Morgan, UC Executive Vice President Nathan Brostrom worked on financings for UC when his firm was contracted in 2003 both as bond broker and swap counterparty for the UC Davis Medical Center swap. UC terminated the swap in 2008 to cap losses at $22.5 million.4

“We shouldn’t be in the banking business, we should be in the education business.” — Leon Botstein, President of Bard College

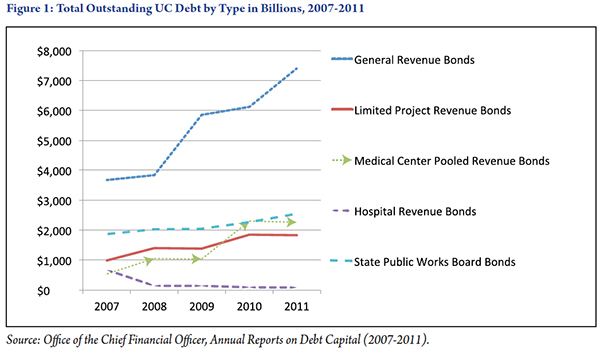

Public funding for the University of California has declined drastically. Between 2007 and 2011, annual state funding of UC declined from $3.8 billion to $2.2 billion. At the same time, UC Regents and executives have increased borrowing via sophisticated financial instruments. Management has more than doubled the university’s debt burden from $6.9 billion in May 2007 to $14.3 billion at the end of 2011 (see Figure 1).5 Although student tuition provides the collateral for much of this borrowing,6 returns on debt-financed investments have not been used to curb drastic tuition increases, and important sectors of UC remain critically underfunded.

Leaving behind UC’s core public education mission, management has poured borrowed money into construction for medical centers, dormitories, and facilities that help attract out-of-state students. Out-of-state enrollment doubled across the UC system from 6% to 12% and tripled at UC Berkeley from 11% to 30% between 2009 and 2011.7 Enrolling these out-of-state students returns a profit to the university because they pay nearly triple the tuition and fees that Californians pay. Similarly, after years of steady increases, annual UC medical center profits stood at $900 million in 2010. These profits are retained within medical centers to fund operations and further development instead of mitigating tuition growth or chronic underfunding in other parts of UC.8

Instrumental to UC’s ability to borrow more aggressively for these investments has been the embrace by the UC Regents and executives of financial derivatives for hedging risk. One such product is the interest rate swap, which has allowed UC to partner with large Wall Street banks over the last decade to issue new types of bonds. While interest rate swaps were thought to guard against some sources of financial risk, they actually increased UC’s exposure to the financial crisis. Further, UC’s swap agreements have made UC vulnerable to losses following from Federal Reserve interest-rate policies and the illegal manipulation of interest rates by Wall Street. Swaps have already cost UC $57 million in borrowing costs and could cost as much as $200 million more over the next 30 years.9

In this report we document the costs of UCs swap agreements. We also show how UC’s use of interest rate swap agreements is part of a broader shift in the management of the university. The result of this shift has been the misguided use of risky financial instruments and misplaced trust in Wall Street banks that have cost UC millions of dollars.

UC’s powerful student market position allows it to compensate for state funding cuts by raising in-state tuition dramatically. However, future exercise of pricing power will more likely be seen in growing non-resident tuition. — Moody’s analysis for its Aa2 rating of for UC Lease Revenue Refunding Bonds in September, 201210

Although UC has taken on billions of dollars of new bond debt, students have consistently born the costs of borrowing while seeing few of its benefits.11 The credit rating agency Moody’s wrote in September 2012 that UC has a very strong rating as a bond issuer precisely because of it can leverage its “powerful student market position” to “compensate for state funding cuts by raising tuition dramatically” and by “growing non-resident tuition, differentiating tuition by campus or degree, and increasing online course offerings.”12

UC management is now using its ability to borrow against future tuition increases to engage in some of the same borrowing practices that led to disaster on Wall Street. Without a change in strategy, UC’s financial management could compound costs paid by students, workers, and faculty in recent years: tuition hikes, class size increases, limited course offerings, unsafe staffing levels, and uncertainty about funding for a secure retirement (see Table 1). UC management tripled average tuition and fees for undergraduates from $4,558 in 2002 to $13,200 in 2012.13 Low-wage UC workers continue to combat poverty.14 Faculty and graduate students fear they cannot continue to attract and retain the most qualified colleagues.15

Renegotiation of interest rate swaps could save up to $10 million a year, and approximately $200 million over the next 30 years. These savings would come at a time when every penny counts for the university. Moreover, redirecting these savings back toward the core mission of the university would be an important step away from borrowing practices that perilously blur the line between profit and public good as the purpose of higher education institutions. Such a step is imperative for a university system with a legacy of world leadership in public education.

FROM RISKY DEAL TO LOSING BET: A SHORT HISTORY OF UC’S INTEREST RATE SWAPS

The past decade has witnessed a qualitative shift in the financial practices of the University of California. Like many other public institutions, the principal way that UC borrows money from investors is through the issuance of bonds. But whereas UC has relied historically on the State Public Works Board to issue bonds secured by the State of California, beginning in 2003 UC began issuing its own bonds secured by expected revenues generated by UC projects.22 As a part of this new financing strategy, UC managers entered into derivative contracts called interest rate swaps. These swaps promised lower borrowing costs than traditional fixed-rate bonds. Instead, in the wake of the financial crisis interest rate swaps have shackled UC to high annual payments despite record-low interest rates.

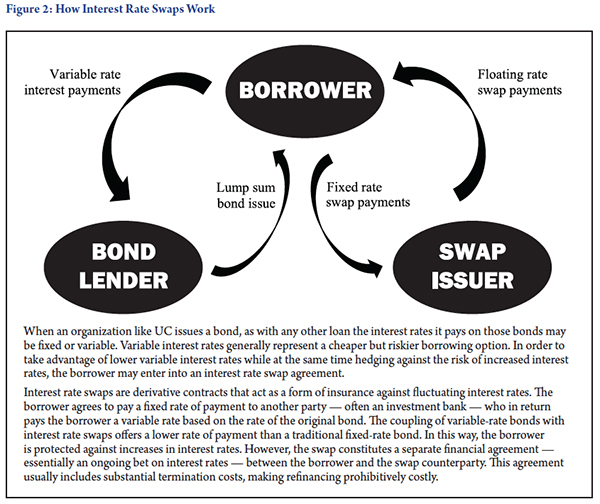

Interest rate swaps are financial derivatives intended to hedge against a sudden spike in interest payments on a bond or other loan. They act as a form of insurance against interest rate volatility by allowing a bond issuer to convert a variable interest rate into a fixed payment (see Figure 2). During the 2000s, many public organizations including UC used interest rate swaps to obtain relatively low, stable payments on variable-rate bond issuances. Between 2003 and 2007, UC entered into three separate agreements involving interest rate swaps with five different investment banks. These swaps were associated with bonds totaling $606 million, all funding development at medical centers on three UC campuses (see Table 2).

UC’s decision to enter into these agreements was part of a broader shift in the way UC manages its finances, from project-by-project funding to a comprehensive strategy for maximizing UC’s utilization of debt financing. As early as fall 2002 the UC Office of the President solicited an analysis from Lehman Brothers, which led to the adoption of a new system of bond issuance secured by the broadest possible range of UC revenue sources.23 In 2006, the UC Office of the President reorganized its leadership structure, creating the new roles of Chief Financial Officer and Executive Vice President for Business Operations and recruiting former Wall Street executives to fill those positions.24 At a January 2007 meeting of the financial committee of the UC Regents, Regents’ concerns that “UC’s approach to debt management was overly conservative” and that “the allocation of debt capacity [had] not been in agreement with UC’s strategic priorities” led them once again to retain Lehman Brothers to develop options for expanding UC’s debt load.25

Exactly how and why UC decided to purchase its interest rate swaps on bonds secured by medical center revenues is unclear. Despite requests by the authors of this report, UC management has not provided documentation for the original swap agreements. Some of these swaps have been replaced by new agreements following the bankruptcy or acquisition of swap counterparties like Lehman Brothers and Merrill Lynch.

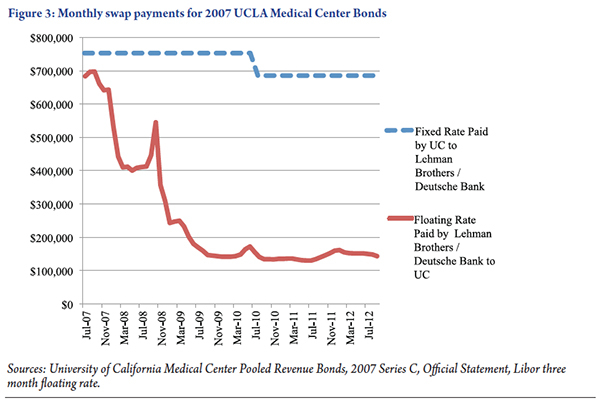

What is clear is that over this period, big banks marketed interest rates swaps to public organizations like UC as a safe way to borrow more money less expensively.26 In reality these swaps created new costs for borrowers when interest rates decline significantly, as they did beginning in late 2007 (see Figure 3). While swaps do insure their holders against general volatility in interest rates, most also have steep termination fees that discourage borrowers from capitalizing on lower market interest rates by refinancing the underlying loans at a new rate. In other words, interest rate swaps were not safe deals, but rather bets on future market conditions.

Rather than safeguarding UC’s fiscal future, these bets have proven to be losers for UC. Because of swap agreements, UC has missed out on refinancing opportunities, instead continuing to pay high fixed rates. Ironically, rock-bottom interest rates have greatly increased UC’s relative debt servicing burden despite the fact that the cost of new borrowing remains at record lows. Losses on the swaps associated with the UC Davis medical center were so significant that UC paid $6.8 million in termination fees when it refinanced the underlying bonds. The swaps associated with medical centers at UCSF and UCLA are projected to create combined annual losses of $9 million. The projected total loss from UC’s engagement in interest rate swaps is more than $200 million.

The interest rate declines that inflated UC’s relative borrowing costs were the product of fundamental changes in the rules of the game that many institutional borrowers did not expect before the financial crisis. First was the move by the Federal Reserve to push interest rates to record lows in order to stabilize large banks and stimulate economic recovery. Between September 2007 and December 2008, the Fed implemented a series of cuts that saw the effective federal funds rate drop from 5.25% to 0-0.25%. Recently, Fed Chairman Ben Bernanke has restated his commitment to keeping interest rates at comparable lows for the foreseeable future.

The second factor that drove down interest rates and increased UCs borrowing costs was the illegal efforts by major banks to manipulate London Interbank Offered Rate (LIBOR), which indexes interest rates on most bonds issued by UC. As interest rates began to plummet in late 2007, the investment banks brokering UC’s bond issues continued to market and sell swaps to borrowers. By 2008 many of the banks had run up enough risky loans on their own balance sheets to push the global economy to the brink of collapse. Under these conditions, major banks engaged in illegal efforts to manipulate LIBOR. These manipulations may have exacerbated UC’s losses, and each of UC’s swap counterparties is under investigation for LIBOR manipulation.

The financial crisis and its responses have had clear effects on the costs of UC’s swap agreements. Unprecedentedly low interest rates mean that UC’s swap payments have ballooned relative to current market rates. As long as interest rates remain low, UC will continue to pay investment banks millions of dollars a year through its swaps. As such, the financial crisis changed the “rules of the game”: while banks received critical public assistance in meeting their debt obligations, public organizations like UC remain on the hook.

RESPONDING TO DERIVATIVE DISASTERS

A range of public institutions —- including states, cities, universities, museums, transit authorities, hospitals and pension funds—are among the principal victims of toxic interest rate swaps and LIBOR rate manipulation. By 2010, taxpayers paid a total of $4 billion to terminate interest rate swap deals with Wall Street banks.27 It is estimated that total government losses on LIBOR rate manipulation could total another $1 billion.28 Given record-low interest rates and the “new rules of the game” outlined above, public institutions face an important choice: Will they accept additional taxpayer losses and pay exorbitant swap termination fees to Wall Street? Or will they hold banks accountable to taxpayers by renegotiating their agreements and pursuing LIBOR litigation?

Derivative Disasters

From Jefferson County, Alabama to Harvard University, there is a long list of derivatives disasters across the US. California’s Water Resources Board spent $305 million terminating interest rate swaps with a group of banks led by Morgan Stanley. North Carolina paid $59.8 million to terminate its swaps agreements, enough to pay annual salaries for 1,400 employees.29 The city of Reading, Pennsylvania paid $21 million on its interest rate swaps, the equivalent of more than a year of real estate taxes.30 Meanwhile, Jefferson County, Alabama, was driven to bankruptcy—the largest of its kind in US history —- as a result of its interest rate swaps (in the process, 1,000 employees, or one quarter of the county’s workforce, had to take unpaid administrative leave).31

Both public and private universities have paid a significant price for their risky bets. The most notorious case is Harvard University, which paid almost $1 billion to terminate its interest rate swaps negotiated under the tenure of the university’s former president, Larry Summers.32 In response, one former Dean of Harvard College stated: “There’s something systematically wrong with Harvard Corp. It’s too small, too secretive, too closed and not supported by enough eyeballs looking at the risks they’re taking.”33 In Tennessee, Vanderbilt University paid $87.2 million to back out of its deals.34 And, as discussed above, the University of California terminated one of its swaps with total losses (including termination fees) totaling $22.5 million.

Alternatives: Swap Renegotiation and LIBOR Litigation

The University of California, however, does not have to be yet another victim of toxic swaps. It can join a growing number of public institutions that are demanding to renegotiate their swap agreements, especially in light of the LIBOR scandal. The San Francisco Asian Art Museum successfully terminated its swaps without penalties, saving the museum $40 million, and the City of Richmond renegotiated its swaps, saving taxpayers $5 million a year.35 The City of Detroit also reduced its swap obligations and is saving $25 million a year (although it continues to lose $54 million a year on other swaps).36 In addition, Peralta Community College recently filed suit against JPMorgan over its interest rate swap deals.37 The City Councils of both Oakland and Los Angeles have voted unanimously to terminate or renegotiate their interest rate swap agreements with Goldman Sachs and Bank of New York Mellon, respectively.38

Since most interest rate swaps are tied to LIBOR, dozens of states, cities and other public institutions are investigating the effects of LIBOR rate manipulation on interest rate swaps, including at least five attorneys general.39 The City of Baltimore and New Britain’s Firefighters Benefit Fund, a pension fund for the Connecticut city, have already filed suit against several banks for LIBOR manipulation.40 In California, the Public Employees Retirement System (CalPERS) and San Francisco’s Bay Area Metropolitan Transit Commission are investigating the impacts of LIBOR manipulation on their swaps.41

All of the banks that have contracted as counterparties for UC’s swap agreements are under investigation for LIBOR rate manipulation. Barclays Capital, which was tied to the UCLA swap through its partnership with Lehman Brothers, was the first major investment bank to be charged and fined by British authorities.42 Deutsche Bank, which took over the swap after Lehman went bankrupt, has also admitted complicity in LIBOR manipulation.43 Bank of America, counterparty to the UCSF swap, has been subpoenaed by investigators in New York, as has JP Morgan, the counterparty to the now-terminated UC Davis swap.

The UC swaps covered in our report were all outstanding for at least some portion of the Class Period in the Baltimore suit. (The UC-Davis Medical Center swaps were terminated about a quarter of the way through the Class Period of August 2007 through May 2010.) The total notional value of UC’s swaps during the Class Period was about $360 million. Based on a -29 bps spread and each swap’s LIBOR factor, we estimate that UC paid banks about $1.92 million more than it should have absent the alleged manipulation of LIBOR.44 Baltimore is suing under federal antitrust statutes and seeking treble damages. Treble damages for UC, based on the $1.92 million estimate, would be $5.76 million.

It remains to be seen whether UC’s Regents will join public institutions across the country that are holding banks accountable for toxic swap deals and LIBOR rate manipulation—or if the university will become yet another derivative disaster.

WHY HASN’T UC MANAGEMENT RENEGOTIATED?

Despite inquiries from the authors, as of the printing of this report UC executives have provided no explanation for their inaction when it comes to renegotiating interest rate swaps. Management has justified medical center and capital projects borrowing in the past by arguing that students and taxpayers would neither bear the costs of borrowing nor benefit from forgoing the borrowing. According to this premise, savings from reduced borrowing costs should not be passed onto students. This premise, however, is false: the Regents have consistently borrowed against public assets and are now also pledging to use future tuition and fee increases to pay off medical center debt.45 It follows that savings resulting from swap renegotiation can and should be passed on to UC students and employees. Banks have argued against renegotiation, claiming that borrowers are bound by contract to honor these disadvantageous agreements. After the 2008 financial crisis changed the rules of the game, however, examples such as the San Francisco Asian Art Museum and City of Richmond clearly demonstrate that it is both possible and desirable to renegotiate swaps.46 So why has UC not at least attempted to renegotiate with its counterparties, Bank of America and Deutsche Bank?

UC Management’s Revolving Door with Wall Street

Wall Street has markedly increased its foothold in the management of the University of California over the last 25 years. This trend has accelerated since a core of UC Regents with ties to Wall Street selected Mark Yudof as UC’s new President in June 2008. In 1990, none of UC’s top management or Regents had worked for or served on the board of a major Wall Street bank.47 Today, current and former business and finance executives play a prominent role on the Board of Regents (see Figure 4).

UC administration has also been restructured to reflect the growing influence of Wall Street. Central to the restructuring was the creation of a new Chief Financial Officer (CFO) position in 2009. The CFO has been responsible for the oversight of new efforts to increase UC’s borrowing. The Regents created the position with support from Wells Fargo Senior Vice President Russell Gould, who chaired the Regents’ Finance Committee at the time.48 Gould had been Executive Vice-President of Wachovia Bank until the Federal Deposit Insurance Commission (FDIC) brokered Wachovia’s bailout and acquisition by Wells Fargo.49 Wachovia had been on the verge of bankruptcy because of aggressive borrowing practices and overexposure to the market for mortgage backed securities.

To fill the new CFO position, the Regents hired Peter Taylor, who had just lost his job as Managing Director of Public Finance for Lehman Brothers/Barclays Capital after Lehman Brothers collapsed in the largest bankruptcy in US history.50 Taylor’s position at Lehman gave him authority for the bank’s sales of financial products to UC. During that period, Taylor also served on multiple governing bodies of the university, including as a Regent, as vice chair of the Regents’ finance committee, and as President, Chair, and member of the UCLA Foundation board of directors.51

Also in 2009, another Wall Street veteran rose to one of UC’s top five management positions: bank executive Nathan Brostrom became the Executive Vice President for Business Services.52 Brostrom had worked for two years in a similar position at UC Berkeley, but before that had spent nearly two decades working on Wall Street, including ten years at JP Morgan Chase. Prior to leaving JP Morgan in 2006, Brostrom became the company’s top executive for its Western Region Public Finance Group. Like Taylor’s position at Lehman, this position gave Brostrom authority over sales of financial products to UC.

Risky Debt and Profits Above All: The Wall Street Strategy for the Budget Crisis

In the face of state funding reductions, the UC Regents, aided by their new executives, dramatically expanded borrowing between 2007 and 2011. Rather than offset cuts, management used much of the borrowing to invest in areas outside of UC’s core mission that were seen as potentially more profitable.

As of 2011, UC has developed protocol for purchasing, modifying, and terminating swap agreements as a tool for this expanded borrowing. The protocol gives significant discretion to Taylor as CFO.71 This new protocol acknowledges that swaps “are derivative transactions and are not without risks.”72 But UC management has not provided records showing evidence of an official interest rate swap protocol before 2011, nor has management provided requested documents showing how swap decisions were made or by whom.

Moreover, at the time this report went to print UC executives had provided no explanation for why they have not sought to renegotiate UC’s swap agreements. But similar cases of complacency in other organizations offer instructive examples. Executives with the Metropolitan Transit Authority in New York — where Vice President Brostrom’s predecessor served as CEO73 —- explained their hesitance to negotiate aggressively with their investment bank counterparties: “It would be ‘bad business practices’ to think of suggesting that the Authority would not place new bonds with a bank unless it agreed to re-negotiate existing agreements.”74

However, an independent arbitration panel for the State of New York Public Employment Relations Board countered such logic in a ruling related to the MTA’s interest rate swaps: “Such renegotiations may not be successful, but it is more than difficult to understand why the Authority is of the opinion that it should not even try.”75 Why do UC administrators seem to be of this same opinion?

Conflicts of Interest?

UC’s outstanding swap agreements are held by banks with close ties to UC executives and Regents. Further, both swap agreements were sold to UC by banks that at the time employed public finance executives who now serve among UC’s top five executives. Unless these relationships are clearly understood, UC decision-making processes about borrowing and renegotiating are not sufficiently transparent and accountable to UC stakeholders.

The UCLA medical center swap—which has already cost UC $23 million —- was sold to UC in 2007 by Lehman’s/Barclays during UC CFO Peter Taylor’s tenure with that firm. At the time, Taylor also served on the board of the UCLA Foundation where he concluded his term as Board Chair just two years earlier. While Deutsche Bank took over the swap after the collapse of Lehman’s, Taylor’s ties to the swap’s origination raise questions about what consideration has been given to renegotiation. This swap also deserves attention because Lehman’s served both as the broker for the bond and the counterparty for the swap — a practice that was not allowed for mortgage derivatives until deregulation under the Glass-Steagall Act of 1999.

The UCSF medical center swap was sold to UC in 2007 by Merrill Lynch,76 which has since been acquired by Bank of America, on whose board Regent Monica Lozano serves. Executive Vice President Brostrom also worked for Merrill Lynch prior to his time at JP Morgan.

The terminated swap for UC Davis, was sold to UC by JP Morgan when Executive Vice President Brostrom managed JP Morgan’s Western Region Public Finance Group.77 Just as Lehman did with the UCLA medical center swap, JP Morgan profited both on the sale of the original bond and on the sale of the related swap agreement to UC — a practice not allowed in other areas of derivative financing.

Based on our findings, we offer recommendations in two areas: the renegotiation of interest rate swaps, and the governance and practices of UC’s overall borrowing program in which interest rate swaps have played an important role.

Interest Rate Swap Recommendations

- UC should seek to renegotiate its existing interest rate swaps with Bank of America and Deutsche Bank. Renegotiation of these swaps could save up to $200 million and fulfill the intended purpose of the Federal Reserve’s near-zero interest rates—supply of low-cost lending to job- and innovation-creators like the University of California.

- UC should review the lawsuit filed by Peralta Community College District against JPMorgan Chase and evaluate its options for legal action against its swap counterparties.

- UC should evaluate its legal options with respect to the manipulation of LIBOR. Deutsche Bank has admitted involvement of its staff in the fraud.78 Bank of America has been subpoenaed, as well.79

Borrowing Policy and Governance Recommendations

- A body composed of delegates from key UC communities — including persons from independent student organizations, faculty organizations, employee unions, and parents — should conduct a comprehensive review of UC borrowing practices. Key issues for consideration include:

- What risk exposure has been created for taxpayers, tuition payers, students, and employees by the doubling of UC’s debt burden since 2007?

- How much of UC’s increased borrowing has been undertaken to fulfill UC’s core mission? How much of UC’s increased borrowing has been used for investing in areas outside of UC’s core mission such as profitable medical services and out-of-state enrollment?

- Have profits from investments financed by UC borrowing been returned to underfunded programs for fulfilling UC’s core mission? Or are profits being reinvested leading to a “mission creep”?

- Have conflicts of interest involving UC Regents, executives, or donors influenced borrowing decisions including decisions on UC’s interest rate swaps?

- A similar body should conduct a review of UC governance of borrowing practices. Key issues for consideration could include:

- To what extent are the UC Regents promising fees as collateral for debt unrelated to its core mission?

- To what extent were all campus constituencies involved in deliberation and a concerted decision to double UC’s debt burden since 2007?

- What expertise is needed for making borrowing policy and decisions other than that provided by executives and Regent’s with close ties to Wall Street? How could student organizations, employee unions, faculty, and the state contribute needed expertise?

- How could all stakeholders — students, faculty, workers, tuition payers, alumnae, tax payers — be equitably involved in governance of UC borrowing practices?

The costs of UC’s interest rate swaps provide a warning about the risks of adopting debt-driven profit strategies and tactics used on Wall Street. UC still has an opportunity to renegotiate and save precious dollars for reversing devastating tuition hikes and cuts. But swift action and involvement by the entire UC community may be necessary. Further, UC-wide involvement in an overhaul of UC’s policies, practices, and governance of borrowing could be a necessary step towards reversing cuts and tuition hikes.

A. UC’s current annual losses on interest rate swaps are calculated as follows:

1. Subtract the fixed interest rate, paid by UC to the swap counterparties, from the variable interest rate, received by UC from the swap counterparties, to arrive at the net interest rate.

[Net interest rate] = [Variable rate received] – [Fixed rate paid]2. Multiply the notional value of the swap by that difference.

[Swap loss] = ([Notional value] x [Net interest rate])We can use the UCLA Medical Center swap as an example. The notional value of this swap is $174,775,000. Under the swap, UC pays its counterparty, Deutsche Bank, a fixed rate of 4.6873% and receives a variable rate equal to 67% of three-month LIBOR plus 73 basis points.80 With three-month LIBOR at 0.35%,81 the variable rate received is 0.9645%.

1. [Net interest rate] = 0.9645% – 4.6873% = -3.7228%.

2. [Swap loss] = ($174,775,000 x -3.7228%) = -$6,506,524

At current interest rates, UC is losing about $6.5 million to Deutsche Bank annually.

B. The calculation of losses to date is largely the same. There are a handful of additional factors to keep in mind, though:

1. Changes in the notional value of the swap. Often the notional value of the swap will decrease each year (to

track decreases in the principal outstanding on the associated bond). For example, whereas the notional value

of the UCLA Medical Center swap was $174,775,000 as of the end of FY2011, it was $189,775,000 as of the

end of FY2010.2. Changes in LIBOR. As LIBOR goes up and down, the variable rate received by UC changes. When the

variable rate exceeds the fixed rate, UC receives a net payment from the bank counterparty, and when the fixed

rate exceeds the variable rate, as it has for several years now, UC makes a net payment to the bank.823. Sometimes swap deals involve premiums and termination charges. For the UCLA Medical Center swap, the

sum of net swap losses from July 2007 through September 2012 total $29 million. But when UC replaced

the original counterparty, Lehman Brothers, after its bankruptcy, with Deutsche Bank, it received an

upfront payment of $31 million from Deutsche Bank. UC also paid a $25.3 million termination payment

to Lehman.83 When the net gain of $5.7 million is subtracted from the $29 million loss, the actual total losses through September 2012 are about $23 million. There were no premiums associated with the UCSF Medical Center swap.C. Projected losses are based on figures reported in UC’s FY2011 financial statements.

1. The statements report projected net swap payments, based on the schedule of future notional values and

variable rates in effect on the statement date—30 June 2011, in the case of the FY2011 statements.2. Because we calculate swap payments from July 2011 through September 2012, we subtract these payments

from the projected payments listed in UC’s FY2011 financial statements.Sticking with the UCLA Medical Center swap, the medical center’s FY2011 financial statement lists future net swap payments of $177,769,000.84 Using the calculation laid out in section A of this Appendix, we calculate net payments from July 2011 through September 2012 of $8,006,922. Taking these net payments from the projected amount listed in the financial statement, the remainder is $169,762,078.

1. “Monica Lozano: At a Glance.” Forbes.

2. P. 36 of UCSFMC’s 2011 CAFR shows future net swap payments through 2036 of $31,597,000. Taking out the 7/11-9/12 net payments already accounted for, the result is $28,435,049.

3. P. 40 of UCLAMC’s 2011 CAFR shows future net swap payments through 2051 of $177,769,000. Taking out the 7/11-9/12 net payments already accounted for, the result is $169,762,078.

4. Official Statement—UC Davis Medical Center Refunding Hospital Revenue Bonds, 2003 Series A-E.

5.“Annual Debt Capital Update to the Regents”; “Annual Report on Debt Capital and External Finance Approvals.” ]

6. “What Do We Pledge to Bondholders?” Capital Markets Finance Newsletter 1(2): 2.

7. Kevin Yamamura. “UC Looks Beyond California to Make Ends Meet.” The Sacramento Bee. May 3rd, 2012.

8. “University of California Report on Audit of Financial Statements and on Federal Awards Programs in Accordance with OMB Circular A-133 For the Year Ended June 30, 2011.”

9. See explanation of calculations in Appendix I.

11. “University of California Report on Audit of Financial Statements and on Federal Awards Programs in Accordance with OMB Circular A-133 For the Year Ended June 30, 2011.”

12. New Issue: Moody’s assigns Aa2 rating to University of California’s approximately $96 million Lease Revenue Refunding Bonds, 2012 Series F issued by the State Public Works Board of the State of California; outlook is stable.” Global Credit Research. September 6th, 2012.

13. For tuition and fees from 2002 to 2011, see “Total Costs of Attendance, UC and comparison institutions 2002-03 to 2010-11.” For tuition and fees in 2012, see “What does UC cost?”

14. Gretchen Purser, Amy Schalet, and Ofer Sharon. “Berkeley’s Betrayal: Wages and Working Conditions at Cal.”

15. Larry Gordon. “UC fears talent loss to deeper pockets.” Los Angeles Times. June 29th, 2011.

16. Calculations based on Appendix A, Official Statement—The Regents of the University of California General Revenue Bonds 2010, Series U, and Appendix A, Official Statement—The Regents of the University of California Limited Project Revenue Bonds 2012, Series H.

17. “Total Costs of Attendance” and “What does UC cost?” op. cit. (n. 9).

18. For 2008 to 2010 new enrollment data see “UC Applicants, Admits and Enrollees, by Residence.” For 2011 new enrollment data, see “Annual Accountability Subreport on the University of California Admissions and Enrollment, p.1.

19. “University of California AccountabilityFramework,” p. 23.

20. Ibid, p. 58.

21. Ibid, p. 56.

22. “The Regents of the University of California. Committee on Finance. July 16th, 2003.”

24. The ambiguity surrounding these new roles caused concern among UC’s academic leadership (c.f. UC Academic Council Minutes. June 21, 2006). The financial leadership of UC before the hiring of these officers in 2009 remains even more opaque.

25. The Regents of the University of California. Committee on Finance. January 18th, 2007.

26. Darrell Preston. “Governments using swaps to emulate subprime victims of Wall Street.” Bloomberg. November 13th, 2011.

27. Michael McDonald. “Wall Street Collects $4 billion From Taxpayers as Swaps Backfire.” Bloomberg. November 9th, 2010.

28. Darrell Preston. “Rigged LIBOR Hits States, Localities with $6 billion,” October 8th, 2012. Bloomberg.

29. Michael McDonald, op. cit. (n. 23).

31. Matt Sherman and Nathan Lane. “Cut Loose: State and Local Layoffs of Public Employees in the Current Recession,” Center for Economic and Policy Research. September 2009.

32. Michael McDonald, John Lauerman, and Gillian Wee. “Harvard Swaps are So Toxic Even Summers Won’t Explain.” Bloomberg. December 18th, 2009.

34. Brian Riesiger. “Vanderbilt University Caught by Interest Rate Swap.” Nashville Business Journal. November 19, 2010.

35. For Richmond, see City of Richmond, “Comprehensive Annual Financial Report for the Year Ended June 30, 2010,” pp. 79-83, and City of Richmond, “Report for the Year Ended June 30, 2009,” p. 85. For the Asian Art Museum of San Francisco, see “Mayor Newsom, City Attorney Herrera, City Controller Ben Rosenfield, President Chiu and Asian Art Museum Foundation Announce Proposal to Restructure Foundation’s Debt.” January 6, 2011: and Reyhan Marnanci, “Asian Art Museum Avoids Bankruptcy” (The Bay Citizen. January 6th, 2011.).

36. City of Detroit. “Comprehensive Annual Financial Report for the Fiscal Year Ended June 30, 2011.” p. 113.

37. Sarah McBride. “California college district sues JP Morgan over financing deal.” Reuters. August 13th, 2012.

38. For Los Angeles, see David Zahniser, “LA wants to quit or alter two bank deals” (Los Angeles Times. March 10th, 2010.). For Oakland, see Tracy Alloway and Nicole Bullock, “Oakland Council Tackles Swap Deals” (Financial Times. August 2nd, 2012).

39. David McLaughlin. “LIBOR Manipulation Probed by 5 State Legal Offices.” Bloomberg. July 17th, 2012.

42. Jill Treanor. “Barclays: from Libor to PPI, the charges in full.” The Guardian. October 31, 2012.

43. “Libor scandal: Deutsche Bank admits some staff involved.” BBC News. July 31, 2012.

44. The floating swap payment received is generally based on percent of LIBOR.

45. “University of California Report on Audit of Financial Statements and on Federal Awards Programs in Accordance with OMB Circular A-133 For the Year Ended June 30, 2011.” p. 2.

46. These agencies have argued that swap renegotiation is appropriate for reasons we described earlier — the rules of the game changed with the 2008 financial crisis after the UCLA and UCSF swap contracts were signed. Nobody expected that the Federal Reserve would bail out Wall Street with nearly free credit for several years. And nobody thought that the big banks would manipulate Libor, increasing losses for UC and other non-profit and municipal swap purchasers. The Fed intended for near zero interest rates to make borrowing cheaper for UC. Instead, because of our derivative contracts, Wall Street is netting larger profits. One might argue that UC is a weaker position than the Asian Art Museum or the City of Richmond for renegotiating because we have no risk of bankruptcy, in which case a bankruptcy court could invalidate our derivative contracts. The Peralta Community College district, however, has brought Morgan Stanley to the negotiating table with no risk of bankruptcy. Morgan Stanley entered negotiations quickly with Peralta, expressing concern about possible damage to the bank’s image from public complaints about course reductions made to fund derivative payments.

47. Charles Schwartz. “A Look at the Regents of the University of California.”

48. “Russell Gould elected Board of Regents’ chairman.” UC Newsroom. May 7th, 2009.

49. Eric Dash and Ben White. “Wells Fargo Swoops In.” The New York Times. October 4th, 2008.

50. Sam Mamudi. “Lehman folds with record $613 billion debt.” Marketwatch. September 15th, 2008.

52. “Nathan E. Brostrom appointed UC executive VP for business operations.” UC Newsroom. January 21st, 2010.

53. Ibid.

54. Ibid.

55. Official Statement—UC Davis Medical Center Refunding Hospital Revenue Bonds, 2003 Series A-E

56. “UC appoints Peter J. Taylor as CFO.” UC Newsroom. March 19th, 2009. Taylor, Peter J. “Resume.”

58. Alan Eyerly. UCLA Newsroom. September 27, 2001.; “Board of Directors.” UCLA Foundation.

59. Taylor, Peter J. “Resume.”

60. P. 40 of UCLAMC’s 2011 CAFR shows future net swap payments through 2051 of $177,769,000. Taking out the 7/11-9/12 net payments already accounted for, the result is $169,762,078.

61. Regents of the University of California. “Regent Monica Lozano.”

62. Ibid.

63. “Monica Lozano: At a Glance.” Forbes.

64. Ibid.

65. P. 36 of UCSFMC’s 2011 CAFR shows future net swap payments through 2036 of $31,597,000. Taking out the 7/11-9/12 net payments already accounted for, the result is $28,435,049.

66. California Strategies LLC. “Russ Gould.”

67. Regents of the University of California. “Regent Russell Gould.”

68. Ibid.

69. Hans Johnson. Defunding Higher Education: What Are the Effects on College Enrollment? Public Policy Institute of California. San Francisco. 2012.

70. Kevin Yamamura. “UC Looks Beyond California.” Sacramento Bee. Thursday, May. 3, 2012. Page 1A.

71. UC Regents Committee on Finance. “AUTHORIZATION TO APPROVE INTEREST RATE SWAP GUIDELINES.” July 13, 2011.

73. “Former New York transportation chief named UC executive vice president for business operations.” UC Office of the President. Thursday, March 15, 2007.

74. State of New York Public Employment Relations Board (PERB Case No. TIA2011-010) Opinion and Award. p. 19.

76. University of California Medical Center Pooled Revenue Bonds, 2007 Series A and B, Official Statement.

77. University of California-Davis Medical Center Refunding Hospital Revenue Bonds, 2003 Series A-E, Official Statement, p. 3.

78. “Libor scandal: Deutsche Bank admits some staff involved.” BBC News. July 31, 2012

Reed Albergotti and Jean Eaglesham. “9 More Banks Subpoenaed Over Libor.” Wall Street Journal. October 25, 2012.

80. University of California Annual Financial Report, 2010-2011, p. 70.

81. Rate as of 3 October 2012, accessed 9 October 2012.

83. University of California Annual Financial Report, 2008-2009, p. 96.

84. UCLA Medical Center Annual Financial Report, 2011, p. 40.

Notably, the courts have not addressed the substance of the allegations in any way the cases up to this point are merely over whether users have the right to bring a suit www.trymobilespy.com/ against apple at all